Self-Hosted Finance: Taking Control of Your Money with Actual Budget

Building your own personal finance stack, one Docker container at a time

💰 My Budgeting Journey: From Diary to Self-Hosted Finance

My personal finance journey started simple — with a pen and paper diary tracking every expense. As my financial life became more complex, I graduated to Google Sheets for better calculations and visualization. But when I discovered the power of dedicated budgeting software, I faced the same question that plagues every homelab enthusiast:

Why pay $14.99/month for YNAB when I could host my own personal finance server — with complete data ownership — and actually control my financial data?

After researching You Need A Budget (YNAB) and seeing the subscription fees add up to hundreds of dollars annually, I decided to take control. Just like I did with my media server and homelab infrastructure, I wanted to own my financial data and break free from the subscription economy.

🎯 The Problem with Traditional Budgeting Apps

Most personal finance apps suffer from the same fundamental issues:

- Data Lock-in — Your financial data lives on someone else’s servers

- Subscription Fatigue — Another monthly bill that never goes away

- Limited Customization — You’re stuck with their interface and features

- Privacy Concerns — Your most sensitive data is stored in the cloud

- Vendor Lock-in — Switching tools means losing years of financial history

Even YNAB, despite being excellent software, falls into these traps. At $14.99/month ($179.88/year), it’s not just expensive — it’s a lifetime commitment to a service you don’t control. That’s nearly $1,800 over 10 years!

🏦 Understanding Personal Finance: Why It Matters

Before diving into the technical setup, let’s talk about why personal finance management is crucial:

The Foundation of Financial Freedom

- Emergency Fund — 3-6 months of expenses saved for unexpected situations

- Debt Elimination — Systematic approach to paying off high-interest debt

- Investment Growth — Building wealth through compound interest

- Financial Goals — Clear targets for major purchases, retirement, or life events

The Psychology of Money

Personal finance isn’t just about numbers — it’s about behavior change. The right tools can help you:

- Visualize your spending patterns and identify problem areas

- Set realistic budgets based on your actual income and expenses

- Track progress toward financial goals with clear metrics

- Build better habits through consistent tracking and review

🚀 Why Actual Budget? The Perfect YNAB Alternative

After testing several open-source alternatives, Actual Budget emerged as the clear winner for my needs:

What Makes Actual Budget Special

- YNAB-Compatible — Uses the same envelope budgeting methodology

- Self-Hosted — Complete control over your data

- Modern Interface — Clean, responsive web app

- Mobile Support — Works great on phones and tablets

- Import/Export — Easy migration from other tools

- Active Development — Regular updates and community support

The Technical Advantages

- Docker-Ready — Deploy anywhere with containerization

- Database Agnostic — Works with SQLite, PostgreSQL, or MySQL

- API Access — Integrate with other tools and automations

- Backup Friendly — Simple file-based backups

- Resource Efficient — Runs on minimal hardware

🛠️ My Self-Hosted Finance Stack

Everything runs on Docker, orchestrated with Portainer on my Synology DS923+. Here’s the complete tech stack:

|

|

Key Components Explained

🏦 Actual Budget Server

- The core application serving your budget data

- Handles user authentication and data persistence

- Provides REST API for mobile apps and integrations

📊 Monitoring Your Financial Health

One of the most powerful aspects of self-hosting your finance tools is the ability to monitor your financial health like any other system:

Key Metrics to Track

- Budget Utilization — How much of each category you’ve spent

- Savings Rate — Percentage of income saved each month

- Debt Paydown Progress — Tracking debt reduction over time

- Emergency Fund Status — Monitoring your safety net

- Investment Contributions — Tracking wealth-building activities

Automated Alerts

- Overspending Warnings — Get notified when approaching budget limits

- Savings Milestones — Celebrate reaching financial goals

- Unusual Spending — Detect potential fraud or budget leaks

- Monthly Reviews — Automated reports for financial check-ins

🔐 Security and Privacy: Your Data, Your Control

Self-hosting your finance tools provides significant advantages:

Data Ownership

- Complete Control — Your financial data never leaves your infrastructure

- No Third-Party Access — No company can access or sell your data

- Custom Backup Strategies — Implement your own backup and recovery

- Compliance Control — Meet your own privacy and security requirements

Security Best Practices

- HTTPS Everywhere — Encrypt all connections with SSL certificates

- VPN Access — Use Tailscale or similar for secure remote access

- Regular Updates — Keep containers and dependencies current

- Backup Strategy — Automated, encrypted backups to multiple locations

Core Features

- Transaction Entry — Automatic Bank Sync(Country Specific)

- Budget Review — Check category balances before spending

- Account Reconciliation — Keep bank accounts in sync

- Goal Tracking — Monitor progress toward financial objectives

Offline Capability

- Sync When Connected — Changes sync automatically when online

- Local Storage — Works without internet connection

- Conflict Resolution — Handles multiple device updates gracefully

🚀 Getting Started: Your First Budget

Setting up your first budget in Actual Budget:

Initial Setup

- Create Accounts — Add your bank accounts, credit cards, and cash

- Set Up Categories — Create spending categories that match your life

- Import Transactions — Upload bank statements or enter manually or Auto Sync bank accounts (Country Specific feature)

- Assign Dollars — Give every dollar a job in your budget

Pro Tips for Success

- Start Simple — Don’t overcomplicate your first budget

- Be Realistic — Set categories based on actual spending patterns

- Review Weekly — Regular check-ins prevent budget drift

- Adjust as Needed — Your budget should evolve with your life

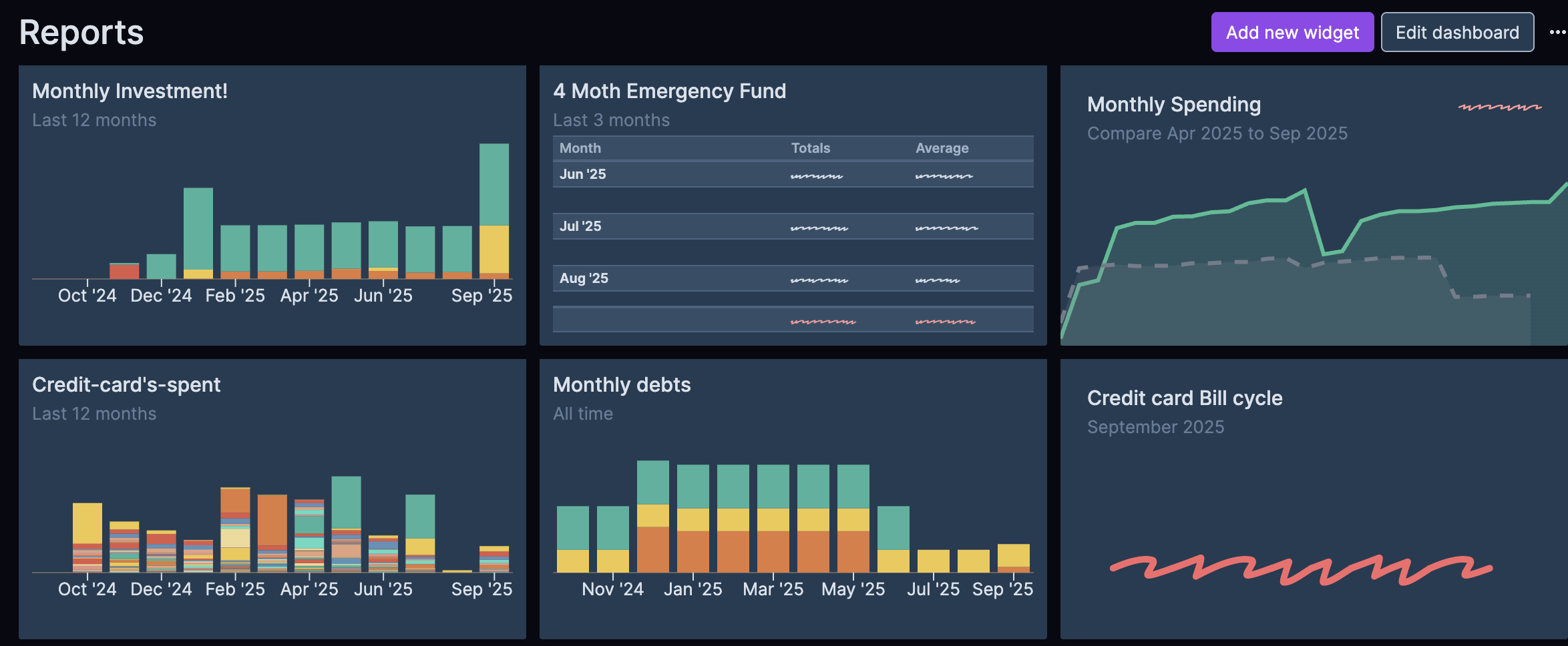

📈 Advanced Features: Beyond Basic Budgeting

Goal Setting and Tracking

- Emergency Fund — Track progress toward 3-6 months of expenses

- Debt Paydown — Visualize debt reduction over time

- Major Purchases — Save for cars, homes, or vacations

- Retirement Planning — Long-term wealth building

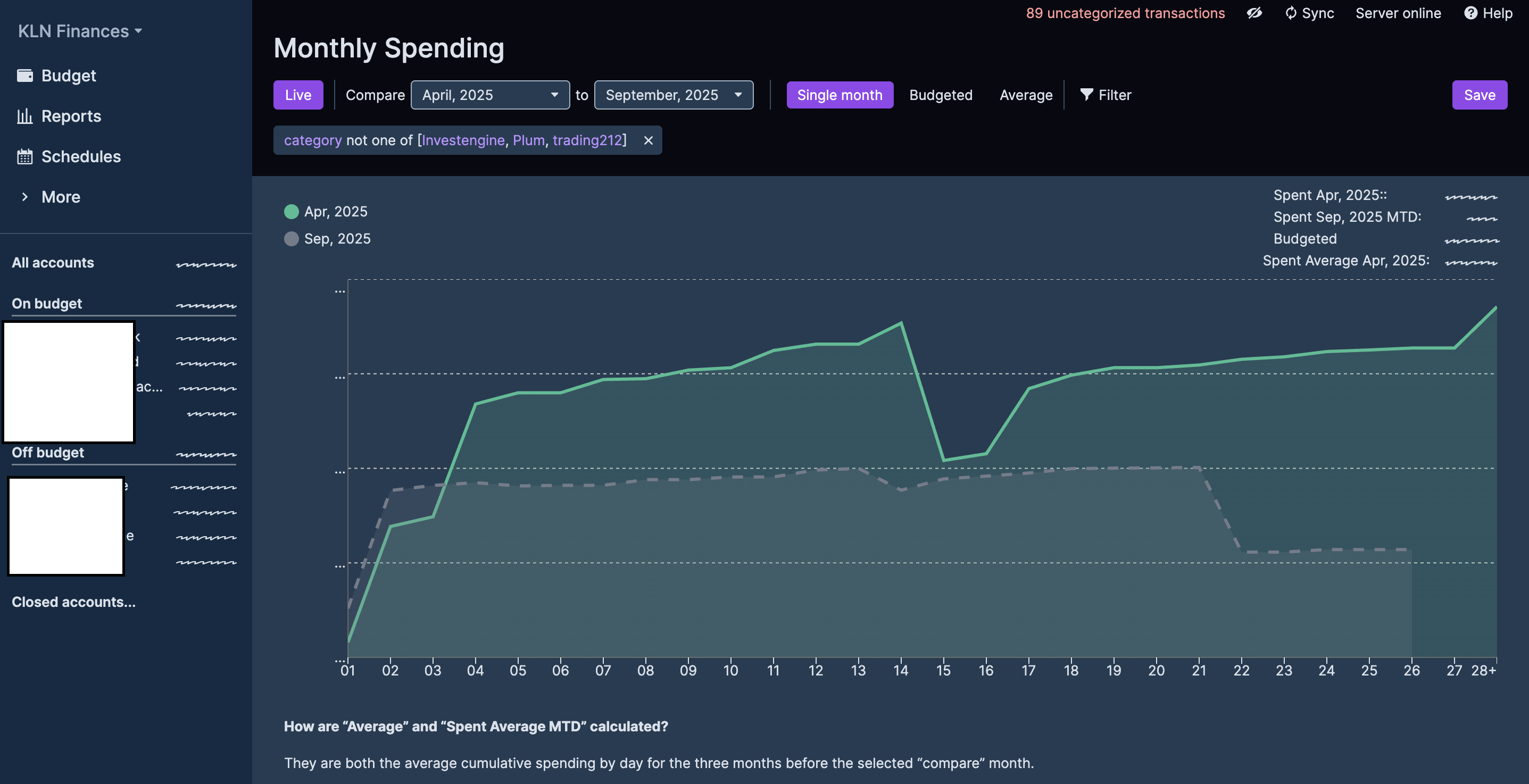

Reporting and Analytics

- Spending Trends — Identify patterns in your expenses

- Category Analysis — See where your money goes

- Net Worth Tracking — Monitor overall financial health

- Goal Progress — Visualize progress toward objectives

- Dashbord Features - Dashboards can be can imported/exported as JSON

💡 The Financial Impact: Real Numbers

Let’s talk about the actual cost savings:

Subscription Savings: YNAB vs. Actual Budget

| Period | YNAB Cost | Actual Budget | Savings |

|---|---|---|---|

| Monthly | $14.99 | $0 | $14.99 |

| Yearly | $179.88 | $0 | $179.88 |

| 5 Years | $899.40 | $0 | $899.40 |

| 10 Years | $1,798.80 | $0 | $1,798.80 |

The Math is Simple:

- YNAB: $14.99/month = $179.88/year = $1,798.80 over 10 years

- Actual Budget: $0/month = Complete ownership and control

- Your Savings: Nearly $1,800 over a decade!

Additional Benefits

- Data Ownership — Priceless peace of mind

- Customization — Unlimited flexibility

- Privacy — Complete control over sensitive data

- Learning — Valuable technical skills

🎯 The Psychology of Self-Hosted Finance

There’s something powerful about managing your money with tools you control:

The Ownership Mindset

- Financial Independence — Not just in money, but in tools

- Technical Skills — Learning valuable homelab skills

- Data Sovereignty — Your data, your rules

- Community — Contributing to open-source projects

The Long-Term View

- No Vendor Lock-in — Switch tools anytime without data loss

- Custom Development — Add features you need

- Cost Predictability — No surprise price increases

- Legacy Support — Keep using tools as long as you want

🛠️ Troubleshooting and Maintenance

Like any self-hosted service, Actual Budget requires some maintenance:

Regular Tasks

- Container Updates — Keep images current for security

- Backup Verification — Ensure backups are working

- Performance Monitoring — Watch resource usage

- Security Updates — Apply patches promptly

Common Issues

- Database Corruption — Restore from recent backup

- Performance Problems — Check resource usage and logs

- Sync Issues — Verify network connectivity

- Import Problems — Check file formats and data integrity

Have questions about setting up your own finance stack? Want to share your budgeting journey? Drop a comment or reach out — let’s build our financial independence together!

🔗 Related Posts:

Building your own cloud, one container at a time 🐧💰